One of The Biggest Impacts of Hurricane Ian was on the Insurance Industry

Hurricane Ian was a powerful and destructive storm that formed in the Atlantic Ocean in September 2014. The storm caused widespread damage and destruction throughout the Caribbean and the southeastern United States. One of the biggest impacts of Hurricane Ian was on the insurance industry, as insurers were forced to pay out billions of dollars in claims to policyholders affected by the storm.

Insurance industry

The insurance industry plays a critical role in helping individuals and businesses recover from natural disasters like Hurricane Ian. Insurance policies provide financial protection to policyholders in the event of damage or loss, and the industry as a whole helps to spread the risk of these events across a large pool of policyholders. However, the insurance industry is also heavily impacted by natural disasters, as insurers are required to pay out large sums of money to policyholders who have suffered damage or loss.

The insurance industry is a complex and dynamic system, and the way in which it responds to natural disasters like Hurricane Ian can have a significant impact on the overall recovery and rebuilding process. Insurers must carefully balance the need to pay out claims to policyholders with the need to maintain financial stability and solvency. In the aftermath of a natural disaster like Hurricane Ian, insurers must quickly and efficiently process claims, assess damages, and make payments to policyholders.

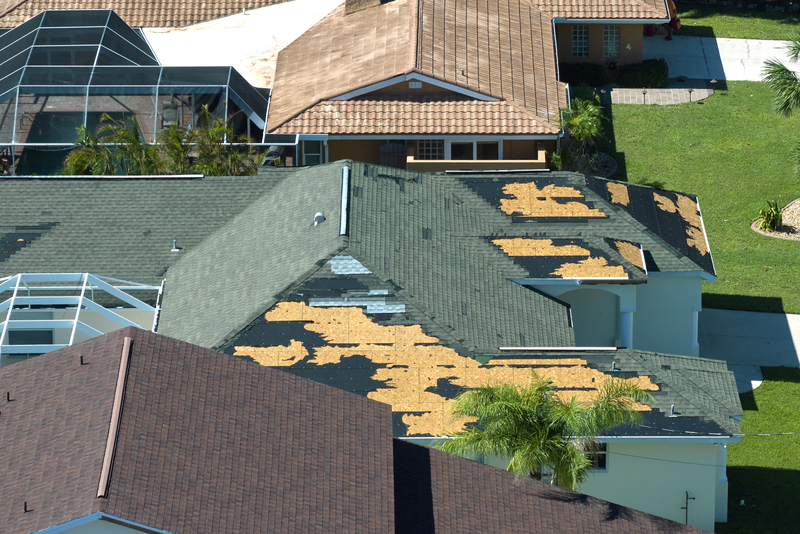

One of the biggest challenges facing insurers in the wake of Hurricane Ian was the sheer scale of the damage caused by the storm. Hurricane Ian was a powerful and destructive storm, and the damage it caused was widespread and severe. This meant that insurers had to process and pay out a large number of claims, which put a significant strain on their resources. In addition, the storm caused damage to a wide range of different types of property, including homes, businesses, and infrastructure. This added to the complexity of the claims process and made it more difficult for insurers to assess and pay out claims quickly.

Another major challenge facing insurers in the wake of Hurricane Ian was the lack of accurate and detailed information about the damage caused by the storm. In the immediate aftermath of the storm, it was often difficult for insurers to get a clear picture of the extent of the damage and the number of claims that would need to be processed. This made it difficult for insurers to accurately assess the overall financial impact of the storm and to plan for the future.

Damages and losses

In the end, Hurricane Ian caused an estimated $2.1 billion in damages and losses. Insurers were forced to pay out billions of dollars in claims to policyholders, and many insurers experienced significant financial losses as a result of the storm. Despite these challenges, the insurance industry ultimately played a critical role in helping individuals and businesses recover from the storm. Insurers provided financial support to policyholders, helping to cover the cost of repairs and rebuilding efforts.

Logistics of processing claims

In addition to the financial challenges faced by insurers in the aftermath of Hurricane Ian, there were also challenges related to the logistics of processing claims and providing support to policyholders. Many policyholders found it difficult to navigate the claims process, and some faced delays in receiving the support they needed. This was partly due to the sheer volume of claims being processed, as well as the fact that many insurers were not prepared for the scale of the damage caused by Hurricane Ian.

To address these challenges, insurers and government officials worked together to set up temporary offices and hotlines to assist policyholders with the claims process. They also provided additional resources and support to help policyholders navigate the claims process and ensure they received the support they needed in a timely manner. Despite these efforts, there were still some policyholders who felt that the claims process was too slow or that they were not receiving the support they needed.

Importance of preparedness and readiness

One of the most important lessons to be learned from Hurricane Ian is the importance of preparedness and readiness. For insurers, this means having the resources and infrastructure in place to quickly and efficiently process claims and provide support to policyholders in the aftermath of a natural disaster. For policyholders, it means being aware of their insurance coverage and understanding the claims process, as well as taking steps to protect their property and belongings before a storm hits.

Accurate and detailed information

Another important lesson is the need for accurate and detailed information about the damage caused by a natural disaster. Insurers rely on this information to assess the overall financial impact of a storm and to plan for the future. The government and other organizations can play a critical role in providing this information, and in helping to coordinate the response to a natural disaster.

Conclusion

In conclusion, Hurricane Ian was a powerful and destructive storm that had a significant impact on the insurance industry and the communities affected by the storm. Despite the challenges faced by insurers in the aftermath of the storm, the industry ultimately played a critical role in helping individuals and businesses recover from the damage caused by Hurricane Ian. The storm serves as a powerful reminder of the importance of insurance in protecting individuals and businesses from the financial impact of natural disasters, and the need for preparedness and readiness in the face of such events.